IRS Notice: Borrowing Against Payroll Taxes

May 29, 2018 | Accounting Help | No Comments

Dear CFO:

I was short of cash and I decided I could use my withheld payroll taxes to pay our company vendors. I did eventually deposit the taxes but I received a notice from the IRS. What should I do?

Payroll Tax Deposit Problem – Baffled in Buffalo

*Disclaimer: This post is not meant to be taken as legal or tax advice.*

Dear Baffled,

You are neither the first person to borrow against your payroll taxes nor the first to be in trouble with the government as a result. You only mention that the IRS has noticed. I am surprised your state didn’t notice first. Borrowing against your payroll taxes may seem like easy money on the surface, but the cost is high.

Late filing is VERY costly. I have personally experienced the high cost of late filing. Once, due to a snowstorm and power outages, I was unable to handle a large deposit in a timely manner. According to the IRS, the storm was not an adequate reason for late filing and much to my chagrin, penalties and interest accrued. It may seem unreasonable, but when we look deeper, the IRS take on the situation becomes apparent.

The main reason late filing is a problem for the IRS is that money you’re using doesn’t belong to you. You borrowed against payroll taxes. Because the money came from your payroll, it belonged to the employees and was in your trust to deposit with the appropriate authorities – state or federal. There are significant consequences for failing to deposit the taxes you withheld. These range from interest and penalties to personal liability with fines. In some cases, failing to deposit taxes can even mean serving time.

What to Do If You Get a Notice from the IRS

The very first step is to acknowledge the notice and deal with it. Ignoring it will only make the situation worse. The IRS won’t go away and certainly won’t forget about the money.

It may seem intimidating, but my best advice is to talk to the IRS. In my experience, the IRS is actually very helpful when you contact them right away. Now, don’t expect that to mean you won’t pay for the mistake. It also doesn’t mean the IRS will accept your reasons (even snowstorms). They will, however, be willing to advise you and explain your best course of action to rectify the situation,

Typically, the IRS lists a reference number and a phone number to call on the notice. The notice will also state an amount due including interest and penalties on the amount you deposited late, if the IRS issued the notice after you made the deposit and filed the appropriate return.

On the other hand, if you didn’t deposit the taxes yet or the IRS notice is dated prior to your deposit, the amount due may bear no resemblance to the deposit you missed. The agency will “guess” at what you owe (or attempt to estimate). Frequently the agency’s guess is significantly higher than the actual amount, plus the balance will include penalties and interest.

Borrowing Against Payroll Taxes: How to Resolve a Sticky Situation

Figure out the best way to get the deposit made.

Keep in mind, extenuating circumstances usually fail to generate a forgiving response from the agency, although there may be some room for negotiation on portions of the fees and charges. Remember that payroll tax is money from your employees in trust for deposit on their behalf. Borrowing against payroll taxes isn’t good practice. If you don’t currently have the cash on hand, it might be best to get your accountant involved to call the phone number and arrange a payment plan.

Make sure the IRS has the right numbers.

If the amount is a guess (If you haven’t paid any of the balance yet), accumulate the proper paperwork to support the amount that you should have paid and submit it with the notice.

If you have already deposited the amount, call and confirm that they have received the payment. Make sure it wasn’t lost in the mail or miscredited in some way. If you discover the payment and notice crossed in the mail, you can expect another notice for the interest and penalty due on the late deposit.

Talk to the IRS.

Keep in mind the agency makes mistakes as well. Again, if you believe the information is wrong, accumulate your support material and submit the backup paperwork along with the notice. I would also call after submitting to ensure the IRS has a record of your call and explanation documented.

Again, I have personal experience. I received a notice from the IRS on a non-payroll related tax issue where they said I owed about $200 for a misfiled return. I provided proof that I had submitted the return properly, at which point I expected them to eliminate the problem. Instead, the next notice I received said they were going to attach my bank accounts and place a lien. Who needs that on their credit report? Fortunately, the situation was resolved successfully, but not until I had spent over an hour on hold. I referred them to the original filing and the subsequent communication convinced them that the filing was proper. While the situation was eventually resolved, it certainly wasn’t simple. Do yourself a favor and document every communication.

As with virtually any problem, if you address your issue with the IRS immediately and communicate clearly, the more likely a fair outcome.

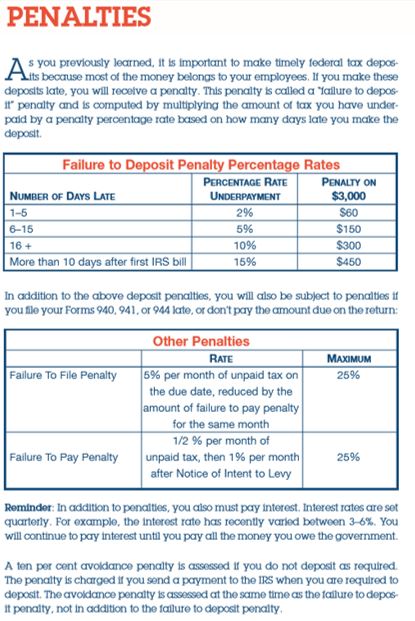

Publication 315 explains deposit requirements with examples and quizzes to confirm understanding. The penalties for late or non-filing as of Dec 2017 are:

This explanation is for Federal charges, but it’s likely your state tax department has a similar publication that explains the deposit requirements there.

The best way to resolve the collection statement you received is with timely filing and payment. Good luck resolving the issue and I would suggest timely filing and deposits in the future. Resolve to never put yourself in the position of borrowing against payroll taxes, even in dire situations. I find the stress of the IRS looking over my shoulder far worse than any other cash flow problems.

Post images by Pepi Stojanovski, featured image by Sharon McCutcheon – via Unsplash.